Implement Proven Strategies for Enhanced Financial Empowerment Through Consolidation in the UK

Evaluate Diverse Consolidation Options for Superior Financial Management

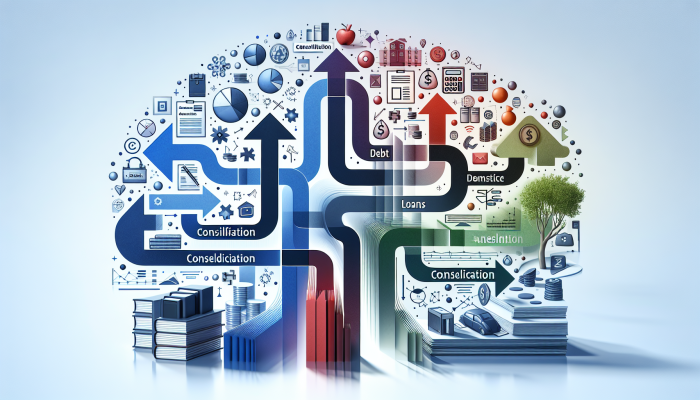

Successfully pairing consolidation with your financial goals is crucial in the UK, as consolidation encompasses various methods specifically designed for diverse financial circumstances. The most well-known approach is debt consolidation, which enables individuals to amalgamate multiple debts into a single, more manageable loan, ideally at a lower interest rate. Options available include personal loans, balance transfer credit cards, or secured loans, where the borrower’s property serves as collateral. On the other hand, loan consolidation concentrates on merging various loans into one convenient payment, which is especially beneficial for those managing student loans, car loans, or personal loans. This approach not only streamlines repayments but can also lead to cost reductions over time, significantly enhancing overall financial management.

Moreover, asset consolidation entails combining different investment accounts or financial assets, simplifying management and potentially lowering associated fees. This practice is gaining traction in the UK, where many individuals maintain multiple pension pots or investment accounts spread across various providers. By consolidating these assets, individuals can decrease costs and attain a clearer understanding of their overall financial position, which facilitates improved decision-making for future investments and retirement planning.

Unlock the Advantages of Financial Consolidation for Achieving Financial Success

The numerous advantages of aligning consolidation with financial goals are especially prominent in the UK. To start, consolidation significantly simplifies an individual’s financial landscape. Rather than managing multiple payments with varying due dates, amalgamating debts or loans into one payment simplifies tracking. This simplification can reduce mental stress, allowing individuals to focus on achieving their financial objectives, whether that involves saving for a house deposit or planning for retirement. Furthermore, the potential for cost reduction stands out as a major advantage. By consolidating high-interest debts into a single, lower-interest loan, individuals can effectively decrease their interest payments, freeing up additional funds for savings or investments. This strategic financial adjustment not only enhances immediate cash flow but can also accelerate progress towards long-term financial goals. Additionally, consistent payments resulting from consolidation can improve credit scores over time by lowering overall debt levels, ultimately contributing to a more secure financial future.

Recognising Risks and Key Considerations in Consolidation Practices

As you explore the consolidation landscape, acknowledging the risks and essential considerations is crucial. While consolidation may seem like a straightforward solution, it can unintentionally lead individuals to incur more debt if they fail to modify their spending habits after consolidation. Neglecting underlying financial behaviours can create a challenging debt cycle that’s difficult to escape. Furthermore, certain consolidation methods, such as secured loans, carry the risk of losing an asset, like a home, if repayments are missed. It is also vital to scrutinise the fees associated with various consolidation products, as these can undermine potential benefits if not carefully evaluated. Borrowers must be vigilant about lenders imposing excessive fees or unfavourable terms. Lastly, not all forms of consolidation are suitable for every financial situation; thus, conducting thorough research and possibly consulting with a financial advisor is essential to ensure that the selected consolidation method aligns with one’s broader financial strategy.

Establish Clear Financial Goals in the UK for Optimal Results

Understanding the Distinction Between Short-term and Long-term Financial Goals

Grasping the difference between short-term financial goals and long-term financial goals is essential in the UK. Short-term objectives typically encompass aims that individuals strive to achieve within a year or two, such as saving for a holiday, establishing an <a href=”https://www.debtconsolidationloans.co.uk/best-debt-consolidation-loans-for-quick-funding/”>emergency fund</a>, or repaying a specific debt. These goals often necessitate immediate action and a clear financial strategy. Conversely, long-term financial goals can extend over several years or even decades, encompassing aspirations like homeownership, retirement savings, or funding a child’s education. Acknowledging the connection between these goals is crucial; successfully attaining short-term goals lays the financial foundation and motivation necessary to pursue long-term aspirations. Therefore, clearly defining these goals sharpens focus and boosts the effectiveness of strategies like pairing consolidation with financial goals.

Utilising SMART Criteria to Enhance Financial Goal Setting

Implementing the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—can significantly improve the effectiveness of financial goal setting in the UK. Specificity entails clearly defining the goal; for instance, “I aim to save £5,000 for a flat deposit within two years,” rather than vaguely stating an intention to “save money.” Measurability involves establishing benchmarks to track progress; for example, saving £250 each month helps maintain focus on targets. Goals should also be achievable, taking into account personal circumstances and current financial situations. Relevance ensures that these goals align with broader life aspirations, thereby enhancing motivation. Lastly, time-bound goals provide definitive deadlines, creating a sense of urgency that bolsters commitment. By structuring goals within this framework, individuals can significantly increase their chances of successfully achieving both short-term and long-term financial objectives.

Aligning Financial Goals with Various Life Stages Across the UK

In the UK, financial goals must be tailored to reflect varying life stages and circumstances. For instance, a young professional might prioritise saving for their first home while also repaying student loans. In contrast, a family may focus on accumulating savings for their children’s education and planning for retirement. As individuals progress through life, their financial priorities naturally evolve; a retiree, for example, may concentrate on sustaining their lifestyle and covering healthcare costs. Recognising these shifting priorities is crucial for effective financial planning. By aligning goals with life stages, individuals can ensure their financial strategies remain relevant and achievable. Moreover, this alignment sustains motivation, as individuals can see their financial goals adapting to their changing circumstances, encouraging a more dynamic approach to financial management that complements strategies like pairing consolidation with financial goals.

Implementing Consolidation Strategies for Financial Success

Conducting a Comprehensive Review of Your Financial Situation

Before embarking on the consolidation journey, it is vital to conduct a thorough assessment of your financial situation. Start by gathering all pertinent financial documents, including bank statements, loan agreements, and credit card statements. This process will provide a clear overview of your income, expenses, and existing debts. Understanding your cash flow is critical; knowing the amount of money entering and exiting your accounts will help identify areas where expenses can be reduced, thereby freeing up more funds for consolidation repayments. Additionally, consider any assets you may possess that could be leveraged, such as property or savings accounts. By critically evaluating your financial health, you can ascertain whether consolidation is the most suitable path for you or if alternative strategies might be more effective in achieving your financial goals.

Choosing the Most Appropriate Consolidation Option for Your Unique Needs

The UK market presents a variety of consolidation options, each with distinct advantages and drawbacks. When determining the most suitable product, consider factors such as interest rates, terms, and fees. For instance, balance transfer credit cards may offer a low introductory rate for transferring existing credit card debts; however, it’s essential to be aware of the rates that will apply once the promotional period concludes. Personal loans can also be attractive, but it is crucial to scrutinise interest rates and any associated fees closely. Furthermore, if you decide to secure a loan against an asset, such as your home, be mindful of the potential risks involved. Ultimately, the right choice depends on individual circumstances, including your credit score, overall debt levels, and financial goals. A tailored approach will ensure that the consolidation strategy aligns effectively with your broader financial objectives.

Enhancing Negotiation Skills with Lenders for Improved Loan Terms

Negotiation is an essential skill for securing favourable terms for consolidation in the UK. Financial institutions are often open to discussions, particularly if you have a solid credit history. Start by researching the rates and terms offered by various lenders; this information will provide leverage during negotiations. Don’t hesitate to express your needs and concerns, whether you’re seeking a lower interest rate, reduced fees, or more flexible repayment terms; being transparent can lead to better offers. Additionally, consider discussing your overall relationship with the bank. If you have been a loyal customer for an extended period, emphasising this loyalty can strengthen your position. Remember that lenders generally prefer to retain customers rather than lose them, making negotiation a powerful tool for securing more advantageous consolidation terms that align with your financial goals.

Implementing Your Consolidation Strategy with Consistent Commitment

Once you have identified the appropriate consolidation strategy, the next crucial step is execution. It is essential to maintain discipline throughout this process. Start by ensuring that all debts you intend to consolidate are paid off promptly, ideally using funds from your new consolidation loan. This step is vital to avoid falling back into the cycle of debt. Establish a structured repayment plan that integrates your new single monthly payment into your budget. Regularly monitor your progress; this not only maintains motivation but also allows for adjustments if your financial situation changes. It’s imperative to track your spending to prevent accumulating new debts while focusing on your consolidation strategy. Adhering to a disciplined and diligent approach will ensure successful consolidation and pave the way for achieving your financial goals.

Integrating Consolidation with Your Financial Aspirations for Success

Creating a Cohesive Financial Plan to Achieve Your Goals

Developing a comprehensive financial plan that effectively integrates consolidation with your financial goals is essential for long-term success. Begin by clearly articulating both your consolidation objectives and your broader financial aspirations. This may involve drafting a detailed timeline outlining when you expect to achieve each goal. For example, if you aim to eliminate debts while simultaneously saving for a mortgage, aligning these timelines accordingly is crucial. Visual aids, such as charts or spreadsheets, can be instrumental in tracking progress and implementing necessary adjustments. Consider involving a financial advisor to help refine your plan, ensuring it remains realistic and attainable. This cohesive approach not only provides a clear pathway forward but also enhances accountability, making it easier to focus on managing and achieving your financial objectives.

Regularly Assessing Progress Towards Your Financial Goals

Monitoring your progress after consolidation is essential to ensure alignment with your financial goals. Regularly evaluate your budget and expenditures to determine whether you are on track to meet your targets. Utilise financial tools such as budgeting apps or spreadsheets to effectively track your spending and savings. Set reminders to review your financial situation at regular intervals, such as quarterly or biannually. This proactive approach enables you to make timely adjustments to your strategy if circumstances change or if you find yourself deviating from your intended course of action. By actively engaging with your financial plan, you can maintain focus on achieving your objectives while also refining your approach to consolidation.

Revisiting Financial Goals After Consolidation to Ensure Ongoing Relevance

After consolidation, revisiting and adjusting your financial goals as necessary is paramount. Life circumstances can change, and with those changes, your priorities may also shift. For instance, if you secure a new position with a higher salary, you might contemplate accelerating your savings or investing in a retirement fund. Conversely, if unexpected expenses arise, it may be prudent to temporarily adjust your goals to accommodate these changes. This flexibility will ensure that your financial strategy remains relevant and effective. Regular evaluations can also help uncover new opportunities to enhance your financial health, such as capitalising on market trends or new financial products. This proactive approach will help you stay aligned with your long-term objectives while navigating the complexities of financial management.

Evaluating the Positive Impact of Consolidation on Overall Financial Well-being

As you progress, assessing the benefits of consolidation on your overall financial health and goals is essential. Have you noticed a reduction in monthly payments? Is your credit score improving? Evaluations should encompass numerical metrics and your emotional and mental well-being regarding financial management. Recognising these benefits can solidify your commitment to both your consolidation strategy and your broader financial goals. Use this evaluation as an opportunity to celebrate milestones achieved and set new challenges. For instance, if debt repayment is proceeding as planned, consider reallocating those funds towards savings or investments. This continuous cycle of evaluation and adjustment is fundamental for fostering long-term financial stability and success.

Vital Financial Tools and Resources Available in the UK

Utilising Budgeting Applications and Software for Enhanced Financial Oversight

Utilising UK-specific budgeting tools can significantly improve your financial management following consolidation. Numerous applications are designed to simplify budgeting, allowing you to track expenses and monitor your financial health effortlessly. Popular options, such as YNAB (You Need a Budget) and Money Dashboard, offer intuitive interfaces tailored for UK users, seamlessly integrating bank accounts and providing real-time updates. These tools can help visualise spending patterns, making it easier to identify areas for potential savings. Moreover, many apps facilitate goal setting, enabling you to align your budgeting efforts effectively with your financial aspirations. Regular engagement with these tools not only keeps your financial plans on track but also fosters a deeper understanding of your spending habits, reinforcing the benefits of pairing consolidation with your financial goals.

Engaging with Tailored Financial Advisory Services for Expert Guidance

Consulting with UK financial advisors can provide personalised advice on consolidation and goal setting. Professional guidance is invaluable, particularly for individuals navigating complex financial situations or seeking to optimise their consolidation strategies. Advisors can offer insights into the best products available in the UK market and help customise a financial plan that resonates with your unique circumstances. They can also assist you in setting realistic and achievable goals, ensuring that your consolidation efforts align with your long-term financial vision. Furthermore, having an expert to consult can provide peace of mind, as they can guide you through potential pitfalls and help you remain accountable to your financial objectives.

Leveraging Educational Resources to Enhance Financial Literacy and Knowledge

Accessing educational resources is fundamental for boosting financial literacy in the UK. Numerous workshops, online courses, and financial literacy programs are available, offering valuable information on consolidation strategies, budgeting, and investing. Institutions like the Money Advice Service provide free resources specifically tailored for UK consumers. Additionally, various community groups and local councils run financial education initiatives designed to empower individuals with the knowledge and skills necessary for effective financial management. Investing time in these resources not only improves financial understanding but also equips individuals with the tools needed to make informed decisions regarding consolidation and overall financial planning.

Utilising Debt Management Tools for Effective Debt Reduction and Oversight

Exploring UK-specific debt management tools is essential for effectively managing and reducing debt after consolidation. Services such as StepChange and National Debtline offer invaluable assistance to those struggling with debt, providing free advice and resources tailored to individual circumstances. These organisations can help develop personalised debt repayment plans and offer ongoing support. Furthermore, understanding additional services such as debt management plans (DMPs) can provide a structured approach to repaying debts over a set period. By utilising these tools, individuals can maintain control over their finances and navigate the path to financial recovery with confidence.

Exploring Investment Platforms for Long-term Financial Growth and Security

Utilising UK investment platforms can be a strategic move for growing savings and planning for long-term financial goals post-consolidation. Platforms like Hargreaves Lansdown, AJ Bell, and Nutmeg offer a range of investment options, from stocks and shares ISAs to pension funds. Engaging with these platforms enables you to explore and diversify your investment portfolio according to your financial goals and risk tolerance. While starting to invest can seem daunting, many platforms provide educational resources and tools to ease the learning curve. By allocating funds toward investments after consolidation, individuals can work towards securing a more robust financial future while reaping the full benefits of pairing consolidation with their financial goals.

Illustrative Case Studies and Success Stories in Financial Management

Motivating Success Stories in Debt Consolidation

Real-life examples of successful debt consolidation in the UK underscore its potential benefits. Take Sarah, a 30-year-old teacher, who was overwhelmed by multiple credit card debts averaging an 18% interest rate. After conducting thorough research, she opted for a debt consolidation loan with a fixed interest rate of 7%. By consolidating her debts into one manageable monthly payment, she not only simplified her financial obligations but also saved over £2,000 in interest throughout the loan’s duration. This successful consolidation strategy empowered Sarah to redirect her efforts toward saving for a house deposit, demonstrating how effectively pairing consolidation with financial goals can work in practice.

The Positive Impact of Loan Consolidation on Financial Stability

John, a young professional residing in London, faced the daunting challenge of multiple personal loans with varying interest rates. After consulting with a financial advisor, he pursued loan consolidation. By merging his loans into a single personal loan at a lower interest rate, John significantly reduced his monthly repayments, freeing up cash to invest in his pension. This strategic move not only alleviated his financial burden but also set him on a path toward achieving his long-term retirement goals, showcasing the value of informed decision-making in the consolidation process.

Strategies for Effectively Consolidating Assets for Better Financial Management

Consider Emma, a UK resident with multiple pension pots scattered across various providers. Recognising the complexity this created, she sought to consolidate her assets for a clearer view of her retirement savings. By transferring her pensions into a single fund, Emma was able to access lower management fees and enhanced investment options. This consolidation strategy not only simplified her financial management but also empowered her to make more informed investment decisions, ultimately aligning her financial resources with her retirement goals.

Reaping the Benefits of Mortgage Consolidation for Homeowners

Homeowners in the UK can also enjoy significant advantages from mortgage consolidation. An illustrative example involves Michael and Claire, who had accumulated various loans alongside their mortgage. By consolidating these debts into a remortgage with a lower overall interest rate, they significantly reduced their monthly payments. This improvement not only enhanced their cash flow but also enabled them to allocate more resources towards their children’s education funds. Their narrative exemplifies the transformative potential of consolidation, highlighting how it can streamline finances and provide opportunities to invest in future goals.

Strategies for Sustaining Financial Health After Consolidation

Establishing a Robust Emergency Fund for Financial Security

Creating an emergency fund is a critical step in maintaining financial health after consolidation. This fund acts as a safety net, providing financial security in case of unforeseen expenses, such as medical emergencies or job loss. In the UK, financial experts recommend saving at least three to six months’ worth of living expenses in an easily accessible account. This proactive approach not only safeguards against future financial challenges but also complements your consolidation efforts by preventing reliance on credit during emergencies. Regularly contributing a set amount to this fund ensures that it grows steadily over time, fostering greater peace of mind and financial stability.

Commitment to Ongoing Financial Education for Empowered Decision-Making

A commitment to continuous financial education is vital for staying informed about trends and strategies within the UK financial landscape. This includes keeping abreast of market changes, new financial products, and evolving economic conditions. Engaging with financial blogs, attending seminars, or participating in community workshops can significantly enhance your understanding of personal finance. By continually educating yourself, you can make informed decisions regarding your financial management, allowing you to adjust your strategies as needed. This dedication not only reinforces the benefits of pairing consolidation with financial goals but also empowers you to take control of your financial future.

Developing a Comprehensive Long-term Financial Plan for Future Success

Ultimately, creating a long-term financial plan is crucial for setting new goals and adapting strategies as the UK’s economic circumstances continue to evolve. This plan should incorporate both short-term needs and long-term aspirations, ensuring a balanced approach to financial management. Regular reviews of your financial situation will help identify areas for growth and opportunities for investment. As life changes occur—such as career advancements or family changes—revisiting and adjusting your financial goals will keep your planning relevant and effective. A robust long-term financial strategy, combined with the insights gained from consolidation, will pave the way for enduring financial health and success.

Frequently Asked Questions About Consolidation and Financial Strategies

What is debt consolidation and why is it important?

Debt consolidation refers to the process of merging multiple debts into a single loan, often at a lower interest rate, to simplify payments and alleviate financial strain, making it easier to manage finances efficiently.

How does consolidation help in achieving financial goals?

Consolidation assists in achieving financial goals by simplifying payments, reducing interest costs, and enhancing cash flow, thereby enabling individuals to redirect funds toward savings or investments more effectively.

What types of loans can be consolidated in the UK?

In the UK, various loans can be consolidated, including credit card debts, personal loans, and even student loans, depending on individual circumstances and financial needs.

Are there any risks associated with consolidation practices?

Yes, potential risks include incurring fees, the possibility of accumulating more debt post-consolidation, and the risk of losing assets if secured loans are involved, requiring careful consideration before proceeding.

How can I assess my financial situation to determine if consolidation is right for me?

To evaluate your financial health, review your income, expenses, and existing debts. Consider utilising budgeting tools and seeking professional advice to gain a comprehensive overview of your financial landscape.

What are SMART goals in the context of financial planning?

SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound objectives that provide a structured framework for effectively establishing and achieving financial aspirations, enhancing the likelihood of success.

What tools can help me manage my finances after consolidating my debt?

Several UK-specific budgeting apps, financial advisory services, and online resources are available to assist in managing finances effectively after consolidation, ensuring sustainable financial practices.

How frequently should I review my financial goals and progress?

Regularly reviewing your financial goals is beneficial, ideally every few months, to ensure they remain relevant and achievable, allowing for necessary adjustments as life circumstances evolve.

Why is having an emergency fund considered important?

An emergency fund provides a financial safety net in unforeseen situations, preventing reliance on credit and helping maintain stability in your financial planning, which is crucial for long-term financial health.

Is it possible to consolidate my mortgage with other debts?

Yes, consolidating your mortgage with other debts is feasible, often through remortgaging, which can simplify payments and potentially lower overall interest rates, enhancing financial management.

Connect with us on Facebook!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Pairing Consolidation with Financial Goals: A UK Guide Was Found On https://limitsofstrategy.com

References:

Consolidation Strategies for Achieving Financial Goals in the UK